A self assessment payment slip is a small but vital paper form sent by HMRC with tax notices. It comes with a tax notice or bill. The slip shows how much tax someone owes. It also gives the reference number for the payment.

Think of it like a receipt request. It tells HMRC who is paying, how much is being paid, and when it is due. Payments can be delayed or misallocated without slip.

Why Does HMRC Send a Payment Slip?

HMRC uses the slip to track payments. Every slip links to one tax account. It makes sure the money goes to the right place.

The HMRC payment slip self assessment helps taxpayers avoid mistakes. Instead of filling out many details, the slip already has key information printed. That saves time and reduces stress.

Who Needs a Self Assessment Payment Slip?

Not everyone in the UK pays tax this way. The payment slip is for individuals submitting self-assessment tax returns. These include:

- Self-employed workers

- Freelancers and contractors

- Landlords earning rent

- Investors making income from savings or shares

- People with foreign income

- Anyone with complex earnings outside normal wages

If HMRC asks for a self assessment, the slip usually arrives with the bill.

How Much to Pay?

Payments on account are advance tax instalments that cover income tax. The Class 4 National Insurance for self-employed people. They are calculated using the previous year’s tax bill. Each instalment equals 50% of that total liability.

The due dates follow a fixed cycle:

- 31 January – during the tax year.

- 31 July – after the tax year ends.

On 31 January, two amounts may be due:

- The balancing payment for the previous tax year.

- The first payment on account for the current tax year.

Both are usually combined into one total amount.

Reducing Payments on Account

Sometimes people who work for themselves pay too much tax in advance. These advance payments are called payments on account. If the upcoming tax bill looks smaller, it’s possible to ask for a reduction.

How to Reduce Payments?

A special form called SA303 helps reduce payments. This form can be sent online or on paper. It can be used anytime before the final tax bill is due.

When filling out the tax return, the option to reduce future payments is also available. The form allows adding a short note to explain why the payment will be smaller next year.

What Happens if Payments Are Too Low?

If payments are reduced too much and the final bill turns out higher, extra money will need to be paid. HMRC (the tax office) will also charge interest on the missing amount. In serious cases, they may add a penalty if the reduction is unfair.

An HMRC Self Assessment tax payment slip is usually sent in specific cases, such as:

- With the annual bill in January or July.

- As part of reminder letters before payment deadlines.

- With notices about overdue or missing payments.

Some taxpayers never receive one, especially if they always pay online. For others who rely on traditional methods, the slip remains an important tool.

How the Payment Slip Is Used?

The slip gives flexibility to those who prefer not to pay digitally. It can be used to make payments:

- At banks or building society branches.

- By posting a cheque with the slip directly to HMRC.

- At selected post office counters.

The main benefit of the slip is that it ensures each payment links correctly to the right tax account.

Paying Without a Slip

Although the slip is useful, it is not always required. Payments can also be made by:

- Accessing HMRC’s online payment services.

- Making a bank transfer using the 10-digit reference number.

- Using the HMRC mobile app.

Digital options are quick and easy, but many still like having a paper slip as extra confirmation.

Where to use Self Assessment Payment Slip?

An HMRC Self Assessment payment slip provides several ways to make a payment:

- At banks or building society branches.

- By sending a cheque along with the slip directly to HMRC.

- At selected post office counters.

In every case, the slip carries the reference code that ensures the money is allocated to the correct tax account.

Benefits of Using a Self Assessment Payment Slip

There are many benefits of slip as following:

- Guides the taxpayer through payment.

- Match the amount with the right account.

- Creates a clear paper trail.

- Reduces stress around deadlines.

For many, these simple benefits outweigh the move to digital.

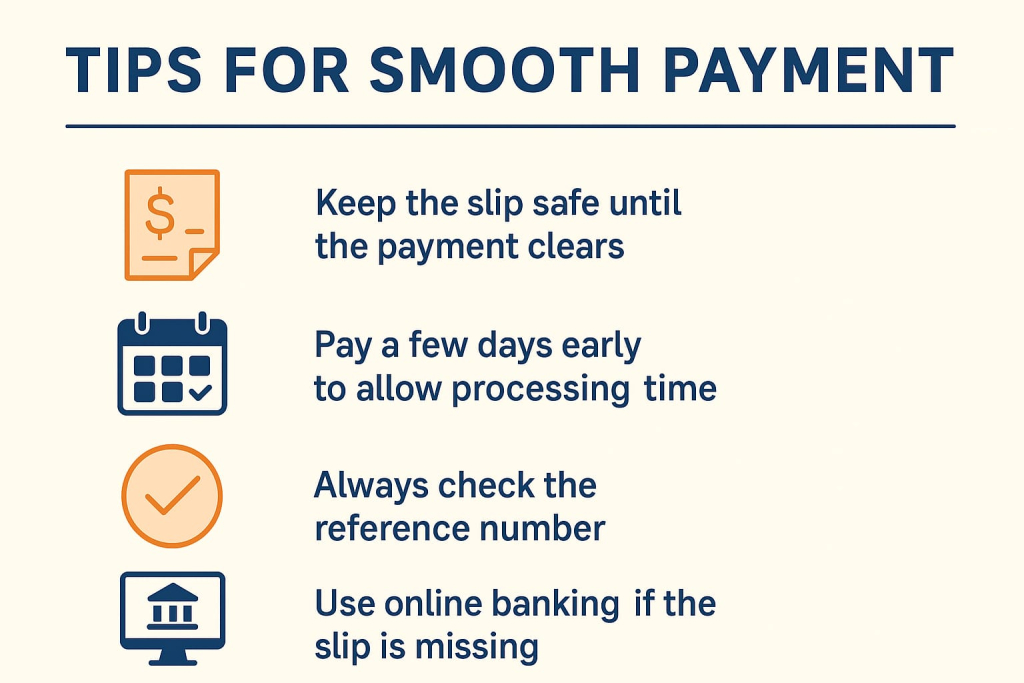

Common Issues with Payment Slips

Like any paper system, slips come with challenges:

- Delays in the post.

- Risk of loss or damage.

- Fewer bank branches now accept them.

Many still trust slips more than the online system despite issues.

Conclusion

The HMRC Self Assessment payment slip makes paying tax easier for many people. It helps link payments to the right account and reduces mistakes. While online methods are fast and common, the slip still gives a useful paper option. Knowing how and when to use it helps keep tax payments simple, on time, and stress-free.

FAQs

What is an HMRC self-assessment payment slip?

It is a paper form that links tax payments to the correct HMRC account.

Does HMRC issue payment slips for voluntary payments?

No, slips are only sent when payments are due.

How frequently does HMRC send self-assessment payment slips?

Normally twice a year—January and July.

Is there a fee for paying tax with an HMRC payment slip?

No fee is charged when paying at banks or by post.

Can businesses use HMRC self-assessment payment slips?

Yes, both individuals and businesses can use them when paying by post or bank.

Are paper self-assessment payment slips necessary for digital taxpayers?

No, digital payment options have replaced slips for many taxpayers.

How long does it take HMRC to process a payment made with a slip?

Usually three to five working days, depending on the method.

Do self-employed workers always get an HMRC self-assessment tax payment slip?

Not always—most self-employed pay online and may not receive paper slips.

Does HMRC still accept cheques with a payment slip?

Yes, cheques with a slip can be sent by post to HMRC.

Contact Us for Free Advice:

To discuss how Accountants in Slough can assist you with your Accounts Preparation, please contact us for a free, no obligation consultation on: 0333 772 1616 or complete our Contact form and we will get back to you.