Getting a gross salary of 65k after tax UK is a big deal. It puts you well above the national average and gives you a lot of options for how to live. The number on your employment contract, which you may have seen in searches for “65k after tax,” is not the amount that goes into your bank account.

To plan your finances well, you need to know how taxes, National Insurance, and other possible deductions will affect you.

This guide will explain what £65,000 a year after tax really means, how it compares to the average UK earner, and how you can make the most of your money, whether you are an individual or getting help from a small business accountant.

What is your take-home pay after taxes?

This is your gross salary if you make £65,000 a year after taxes. Your net salary, or take-home pay, is what you get after the government takes its share through National Insurance and Income Tax.

Your monthly net pay can also go down because of other deductions, like contributions to your pension and payments on your student loans. If you work with Berkshire Accountants, you can better understand and plan for these deductions, which will help you keep your finances in order.

Let’s look at the standard deductions for the 2025/2026 tax year in England, Wales, and Northern Ireland. Scotland has its own tax bands, which we’ll talk about later.

- Income Tax: The UK has a progressive tax system, which means that people in higher income brackets pay a higher rate.

- National Insurance (NI): These payments help pay for state benefits like the NHS, the State Pension, and the Jobseeker’s Allowance.

- Contributions to the Pension: Automatic enrolment doesn’t mean that employees have to pay taxes, but it does mean that most of them do. The minimum amount is 5% of your qualifying income.

If you make £65,000 a year, here’s a simple way to figure it out:

Gross Annual Salary: £65,000 – Pension Contribution (5%):£3,250 – Taxable Income: £61,750 (£65,000 – £3,250)

Let’s now use the tax bands on your taxable income:

- Personal Allowance: You don’t have to pay taxes on the first £12,570 you make.

- Basic Rate: If you make between £12,571 and £50,270, you pay 20% tax on that money.

- Higher Rate: You pay 40% tax on money you make between £50,271 and £125,140.

How to Figure Out Your Income Tax:

– £0 on the first £12,570.

– 20% of the next £37,700 (£50,270 – £12,570) = £7,540 – 40% of the remaining £11,480 (£61,750 – £50,270) = £4,592

– **Total Income Tax for the Year:** £12,132

Calculating Your National Insurance:

– You pay 8% on money you make between £12,570 and £50,270.

– You only pay 2% on money you make over £50,270.

– 8% of £37,700 is £3,016. – 2% of £14,730 (£65,000 – £50,270) is £294.60.

– Total National Insurance for the Year: £3,310.60

Putting It All Together (What You Get to Keep Each Year):

Gross Salary: £65,000 – Less Pension: -£3,250 – Less Income Tax: -£12,132 – Less National Insurance: -£3,310.60 – Estimated Annual Nett Pay: £46,307.40

Estimated Monthly Take-Home Pay: About £3,859

Accountants in Slough or any chartered accountant in Berkshire can tell you that this is just an estimate. Things like paying off student loans, different rates for pension contributions, or benefits in kind (like a company car) will change how much money you take home.

If you want to know exactly how much money you have or if you make a lot of money, an accountant in Maidenhead could help you get the most out of your 65k after tax UK.

How does a £65,000 salary compare to the average in the UK?

If you make £65,000 a year, you’re comfortably in the top tier of earners in the UK. The Office for National Statistics (ONS) says that in 2024, the median gross annual earnings for full-time workers in the UK was about £35,000.

This means that a salary of £65,000 after taxes is almost twice as much as what the average full-time worker makes. A lot of people search for “65k after tax UK” to find out how this income level stacks up against others.

This amount of money puts you firmly in the higher-rate tax bracket, which only about 15–20% of UK taxpayers reach. This means that you pay a higher percentage of your income in taxes, but it also means that your financial situation is much better than most people’s.

You are in the top fifth of earners in the country, which means you have more money than most people. If you want to get the best tax situation possible at this income level, it is a good idea to talk to chartered accountants in Berkshire or small business accountant advisors.

How far does your salary go when you live?

A salary of £65,000 is a lot, but how much you can buy with it depends a lot on where you live. The cost of living in the UK varies greatly from region to region, with housing being the biggest factor.

That’s why a lot of people who work with Berkshire Accountants or look for “Accountants in Slough” think about local living costs and tax planning as part of their whole financial plan. An accountant in Maidenhead can often give you budgeting advice that is specific to your area if you want to make the most of your 65k after tax.

Housing:

This will be the most money you spend each month.

London and the South East: A monthly income of about £3,859 can feel tight. You can easily spend more than £2,000 a month on rent for a one-bedroom apartment in London, which is more than half of your nett income. It’s also very hard to buy property, with down payments on even small homes costing tens of thousands of dollars.

Big Cities (Manchester, Bristol, Edinburgh): These cities have a better balance. The cost of renting a one-bedroom flat could be between £1,000 and £1,500. This gives you more money to save, invest, and have fun with.

Northern England and Other Regions: Your money will go a lot farther in cities like Liverpool, Newcastle, or Sheffield. Rent for a similar property could be as low as £700 to £900, which would give you a lot more financial freedom and help you save for a property deposit much faster.

Getting around:

Your travel and commute costs will also be different.

Living in the City: You might not need a car if you live in a city with good public transportation. A monthly travel pass in London (Zones 1-3) costs almost £200. In Manchester or Birmingham, it might be closer to £80-£100.

Living in the suburbs or the country: You need a car more and more. You should plan for fuel, insurance, taxes, and maintenance, which can easily add up to £300–£400 or more a month, depending on the car.

Other Important Costs:

Utilities: The council tax is a big expense. A Band D property can cost anywhere from more than £2,000 a year in some parts of the South East to about £1,500 in other parts. Gas, electricity, and water will probably cost an extra £150 to £250 a month.

- Groceries: A single person or couple can expect to spend between £300 and £500 a month on groceries, depending on how they eat and where they shop.

- Phone and Broadband: This usually costs between £50 and £80 a month.

It’s interesting to note that a lot of people who are looking at their finances at this income level search for terms like “65k after tax UK” or talk to accountants in Slough. To sum up, a monthly take-home pay of £3,859 is more than enough to live comfortably in most of the UK. In London, though, you need to be careful with your money if you want to live alone without feeling financially strained. If you want to save and invest better, you should look for a small business accountant or a chartered accountant in Berkshire.

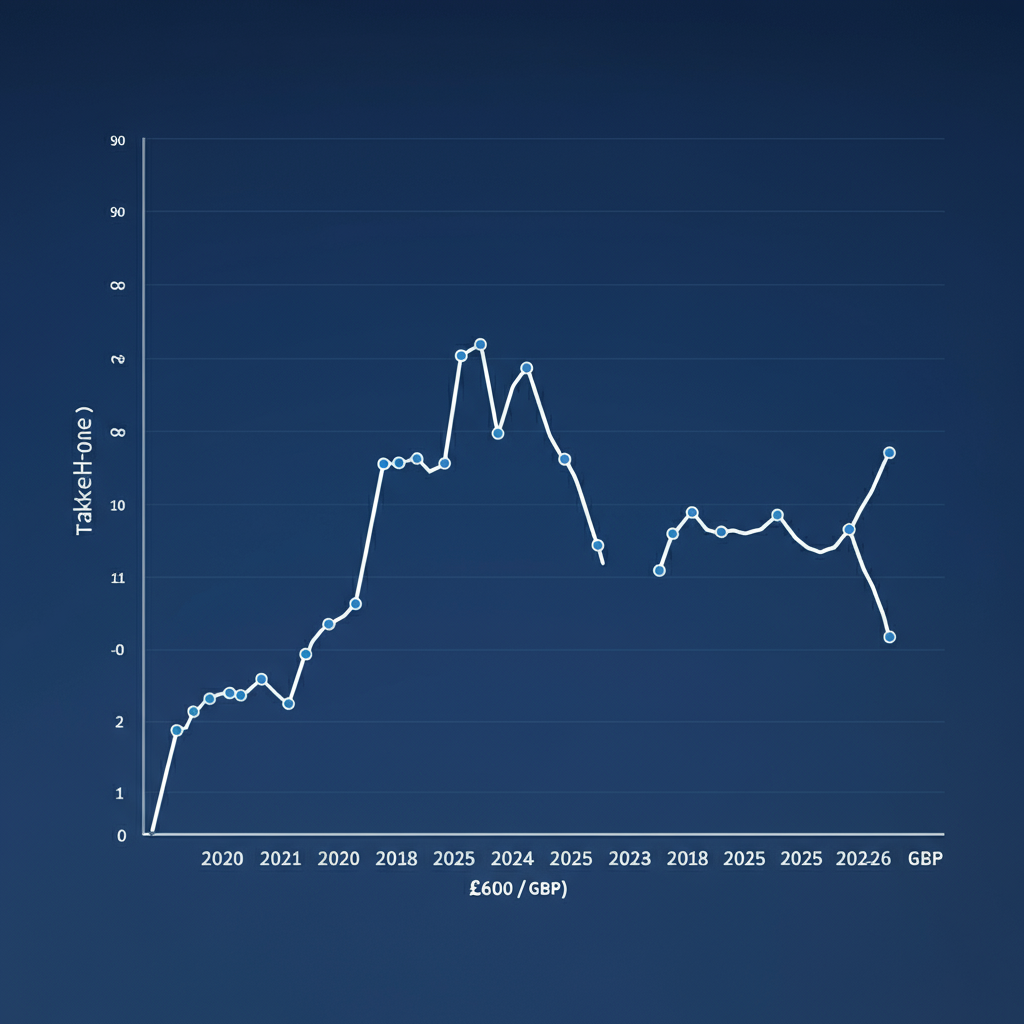

Here is a summary of the approximate take-home pay for a £65,000 salary in the UK for the tax years 2020 through 2025. The figures account for standard personal allowances, income tax, and National Insurance contributions for each year.

| Tax Year | Gross Salary | Income Tax | National Insurance | Net Take-Home Pay |

| 2025-26 | £65,000 | £13,432 | £3,311 | £48,257 |

| 2024-25 | £65,000 | £13,432 | £3,311 | £48,257 |

| 2023-24 | £65,000 | £13,432 | £4,685 | £46,883 |

| 2022-23 | £65,000 | £13,432 | £5,300 | £46,268 |

| 2021-22 | £65,000 | £13,432 | £5,431 | £46,137 |

| 2020-21 | £65,000 | £13,486 | £5,331 | £46,183 |

I’ve created a line graph illustrating the net take-home pay for a £65,000 salary in the UK from 2020 to 2025. It’s now available on your Canvas.

How to Make the Most of Your Money and Budget?

Getting a higher salary is a great way to build wealth and make sure your financial future is safe. The important thing is to be smart with your money instead of letting your spending rise to match your income.

This is called “lifestyle creep.” When looking for professional financial advice, many successful people at this level work with Berkshire Accountants or search for terms like “65k salary after tax.”

-

Use the 50/30/20 Rule as a Guide

This well-known budgeting method is a good place to start:

50% on Needs: Set aside up to 50% of your nett income (£1,930) for things you need, like groceries, rent or mortgage, bills, and transportation. This category may need a bigger share if you live in an area that costs a lot.

30% on Wants: You can spend up to 30% (£1,158) on things you want to do, like going out to eat, doing hobbies, going on vacation, and having fun.

20% for paying off debt and saving money: Set aside at least 20% (£772) of your money for your financial goals. This could mean putting money into an emergency fund, investing, paying off your mortgage too much, or paying off debt with high interest rates.

If you talk to a small business accountant, they might change this ratio to fit your needs, especially if you have both business income and your personal 65k after-tax UK salary.

-

Make the most of your pension contributions

You are in the 40% tax bracket, so putting money into your pension is a very tax-efficient way to save. It only costs you £60 from your take-home pay for every £100 you put into your pension. The government adds the £40 in taxes you would have paid.

A lot of employers will also match contributions that are higher than the minimum. If your employer matches your contributions by 7%, for example, giving 7% of your own money is like getting free money.

Case Study: Living on a £65,000 Salary in the UK

-

Profile of the Client: A professional who makes £65,000 a year before taxes.

Goal: To look at the net take-home pay from a 65k after tax UK and see how it affects budgeting, lifestyle, and financial planning in the real world. Knowing how much money you have after taxes can help you manage your money better, whether you work full-time or as an accountant for a small business.

-

Salary Breakdown: From Gross to Net

A salary of £65,000 is well above the national average, but the gross amount doesn’t show how much money is available for monthly expenses. We need to include mandatory deductions like Income Tax and National Insurance in order to get a clear picture of our finances. A lot of professionals, like those looking for a chartered accountant in Berkshire or Berkshire Accountants, need to know exactly how much money they will make after taxes on their 65k salary.

The following are the deductions based on the tax rates in England, Wales, and Northern Ireland for the 2025/26 tax year:

- Gross Annual Salary: £65,000 – Personal Allowance: £12,570 (the amount you can earn without paying taxes)

- Taxable Income: £52,430

Deductions:

- Tax on Income: There are two bands for taxable income. The first £37,700 is taxed at the basic rate (20%), and the rest, £14,730, is taxed at the higher rate (40%).

– Total Income Tax: £13,432 – National Insurance: Contributions are based on income that is higher than the threshold.

– Total National Insurance: £3,311

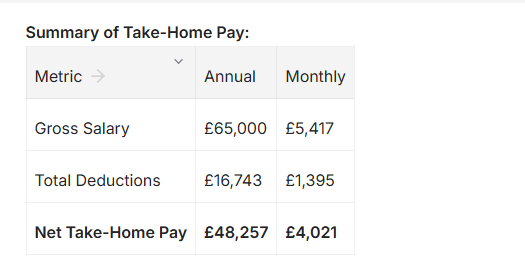

Summary of Take-Home Pay:

This analysis shows that about 26% of the gross salary is taken out for taxes and contributions, leaving a monthly net income of just over £4,000. This is useful information for anyone looking into 65k a year after tax or talking to an accountant in Maidenhead.

-

How to budget and how it affects your lifestyle

The person has a good base for a comfortable life because they make £4,021 a month after taxes. However, the cost of living, especially housing, has a big effect on disposable income.

When people in Slough look for accountants or plan with a small business accountant, they often think about how much 65k a year after taxes is worth when deciding if they can afford it.

-

Scenario A: Living in a Big City (like London or Bristol)

The most expensive thing is housing. Renting a one-bedroom flat in a good area can take up a lot of your money. Berkshire Accountants can help you make the most of your money in situations where you make about $65,000 after taxes.

Housing (Rent & Utilities): £1,800 – £2,200 – Living Expenses (Groceries, Transport, etc.):** £700 – Discretionary Spending (Social, Hobbies): £500 – Total Monthly Expenses: £3,000 – £3,400

In this case, the person has between £621 and £1,021 left over every month. This extra can

How much is 65k a month after taxes?

If you make £65,000 a year in the UK, you are in the higher-rate tax bracket. This means that a lot of money is taken out of your pay before it goes into your bank account. The main things that are taken out are National Insurance and Income Tax.

Your £65,000 salary is taxed progressively in England for the tax year 2025/2026. You get a tax-free Personal Allowance of £12,570. If you make between £12,571 and £50,270, you pay 20% in taxes. If you make more than £50,271, you pay 40% in taxes.

There is also a National Insurance tax, which is usually 8% on income between £12,570 and £50,270 and 2% on income above that.

Your annual net pay, or take-home pay, is about £49,557 after these deductions are figured out and added to your pay. If you want to know how much 65k after tax UK is, this annual net amount comes out to about £4,130 a month.

This number may be a little different depending on things like your tax code, pension contributions, and student loan payments, but it gives you a good idea of how much money you make each month.

How much is 65k a year after taxes?

In the UK, a salary of £65,000 a year means that after taxes and National Insurance contributions, you will take home about £48,257 in 2025. This is about £4,021 a month. The deductions add up to £3,311 in National Insurance and £13,432 in Income Tax each year.

Contact Us for Free Advice:

To discuss how Accountants in Slough can assist you with your Accounts Preparation, please contact us for a free, no obligation consultation on: 0333 772 1616 or complete our Contact form and we will get back to you.